The following is the trading and profit and loss account of a Private Ltd. company for the year ended June 30, 1998. And Bankrate has identified some top low-cost ETFs for major segments of the market. In today’s competitive market, attracting and retaining customers is a challenge for any business…. If a company has a high P/E ratio, that may mean its share price is high relative to earnings, potentially making it overvalued.

Administrative Expenses

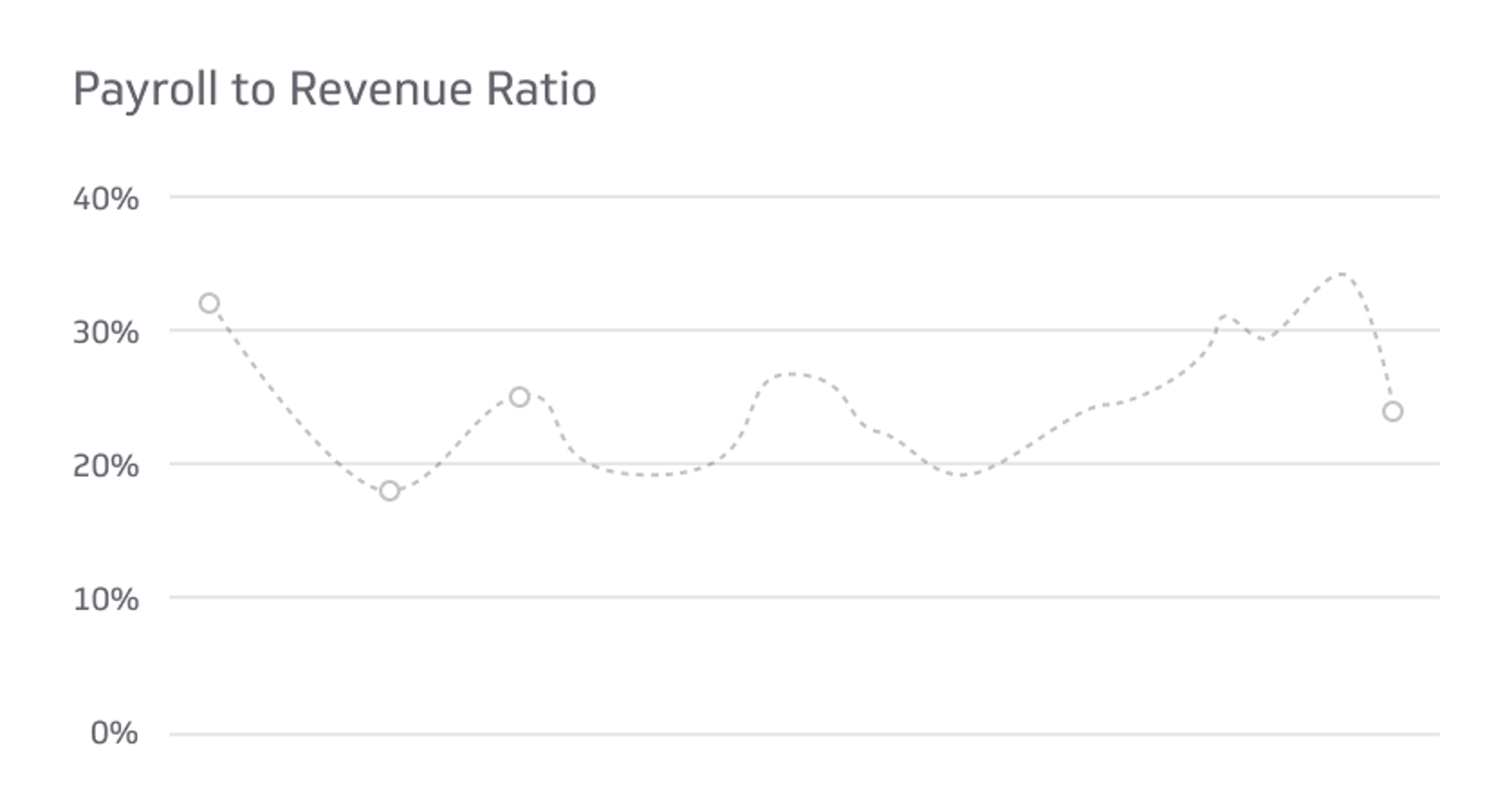

By calculating and interpreting these ratios, organizations can identify areas of improvement, optimize resource allocation, and enhance overall operational efficiency. Financial ratios can help you compare one company’s financial results to another or track the performance of a single company over time. Profitability and expense ratios measure customer demand, company pricing power and cost management efforts. Being able to calculate specific ratios from financial statements can provide an investor with insight into various investment alternatives. These profitability ratios compare investments in assets or equity to net income.

- Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index.

- Some subcategories include raw materials, people through wages and salaries, and manufacturing supplies.

- In retail, your costs are generally divided into fixed and variable costs.

- By considering different perspectives and utilizing appropriate analysis techniques, businesses can gain valuable insights into their financial performance.

What is your current financial priority?

This return ratio reflects how well a company puts its capital from all sources (including bondholders and shareholders) to work to generate a return for those investors. It’s considered a more advanced metric than ROE because it involves more than just shareholder equity—it considers all the capital that is being used by the company to generate the profits. Net profit margin is seen as a bellwether of the overall financial well-being of a business. It can indicate whether company management is generating enough profit from its sales and keeping all costs under control. A company’s profitability ratios are most useful when compared to those of similar companies, the company’s own performance history, or average ratios for the company’s industry.

What are the Components that Make Up the Expense Ratio?

(!) Remember, SalesNash specializes in lead generation and appointment setting, offering an effective solution for outsourcing outbound efforts. This can help you keep your expense to revenue ratio low while reducing CPL and CPA. The answer to whether an expense ratio is a good one largely depends on what else is available across the industry. Many investors look at earnings per share as a way to determine which stocks they favor by comparing the ratio with the share price.

The Fidelity Contrafund (FCNTX) is one of the largest actively managed funds in the marketplace, with an expense ratio of 0.39% ($39 per $10,000 invested). This fund is much more highly weighted toward communication services than its benchmark, the S&P 500. Determine the operating expense – This is the most important step where the operating expenses should be correctly identified after gathering the value of each of them for a specific period. Then make a total of all such expenses for the numerator of the formula. To calculate the operating expense ratio for financial analysis purposes, it is necessary to know the formula used for the calculation.

What are expense ratios? These fees could be eating away at your investment earnings

Ratios are best used as comparison tools rather than as metrics in isolation. Funds with an initial asset base of Rs. 500 Crore carry a maximum total expense ratio of 2%. The next Rs. 250 Crore incurs a ratio of 1.75%, and any amount beyond that is subject to a 1.5% ratio. This fee is applied annually as long as you possess the fund throughout the year. It’s crucial to note that attempting to sell the fund just before a year lapses doesn’t exempt you from this cost. In the case of an ETF, the management company discreetly deducts the cost from the fund’s net asset value on a daily basis, making it virtually imperceptible to you.

Investors should evaluate the management team’s track record and consider whether the additional fees are likely to result in better investment outcomes. The impact of expense ratios on investment performance becomes more pronounced over time due to the compounding effect. It measures your financial health and whether you efficiently manage your store. Tracking this ratio helps you determine where to reduce costs and gives you an impetus to find creative ways to increase revenue. Likewise, if your variable expenses are too high, your profit margins might shrink as you sell more. Using your point of sale (POS) system to track sales data and seasonal changes here is a good idea to help prepare for fluctuations.

They are economic resources that will be consumed and used in a process other than preparing financial statements during the subsequent accounting period. These are general expenses that are there in the running of the business. Control of overhead costs is also possible when they are managed appropriately.

Expense ratios directly impact an investment’s returns by reducing the amount of money available for investment growth. A higher expense ratio means that more of an investor’s money is being used to cover expenses, potentially leading to lower returns over time. In this article, capital lease vs operating lease we’ll unravel the cost to revenue ratio, how it affects your profitability and overall store growth, and how to improve a poor ratio and cash flow management. This metric can provide the clarity you need to make informed decisions about cost management and revenue generation.

This means that 35% of its revenue is allocated towards operating expenses. By comparing this ratio with industry benchmarks or historical data, Company XYZ can assess its cost management practices and identify areas for improvement. Expense ratios are financial metrics that measure the proportion of a company’s expenses to its revenue or income. They help evaluate the efficiency of cost management and identify areas where improvements can be made.